As U.S. Tax Court Judge Mark Holmes gets ready to render a decision in a huge case examining whether money is owed in estate taxes from Michael Jackson's death in 2009, the Internal Revenue Service has caught a small break. The judge is refusing to strike testimony from Weston Anson despite acknowledging that the government's key valuation expert wasn't truthful during the February trial.

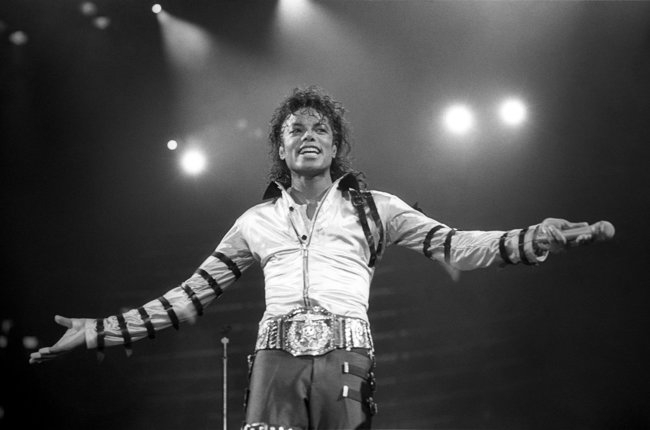

Anson appeared on the witness stand to bolster the IRS' contention that the worth of Jackson's name and image at the time of death was $161 million instead of just $2,105 as the other side submits. The case is a pathbreaking one that will establish some guidance around the value of celebrities posthumous rights for estate tax purposes. (That is, if estate taxes survive any tax reforms being contemplated by lawmakers.)

During the trial, the Michael Jackson Estate cross-examined Anson by asking him whether he worked for the IRS before.

Anson said he hadn't.

But Anson was working on another case where the IRS seeks money from the Whitney Houston's estate.

Questioned about this, Anson said, "We've not yet begun any work on the case."

Attorney Howard Weitzman then asked Anson if he had written an IP valuation of Whitney Houston.

"Absolutely not," responded Anson.

In a motion to strike, the Michael Jackson Estate would present how Anson and CONSOR Intellectual Asset Management had in fact prepared and submitted a report dated June 8, 2015, titled, "Analysis of the Fair Market Value of the Intangible Property Rights Held by the Estate of Whitney E. Houston as of February 11, 2012 for Estate Tax Purposes."

Evidently not willing to determine that untruths were said willfully, Judge Holmes refuses to say whether this was perjury or not.

"We will start first with the question of whether Mr. Anson's false testimony rises to the level of perjury, and here we will duck," writes Holmes in an order. "Perjury is a criminal offense with elements above and beyond misrepresentation. It is governed primarily by two federal criminal statutes ... and this is not a criminal proceeding. We will instead simply find that Mr. Anson lied under oath because the parties don't dispute that he did."

And the ramifications? Does the IRS lose its key expert?

"There has to be some consequences for Mr. Anson's false testimony about his dealings with the IRS, but to in effect strip the Commissioner of any expert-testimony about the value of the Estate's assets because of Mr. Anson's parsimonious relationship with the truth about his dealings with the IRS in other cases seems to us too severe," Holmes later writes. "A more proportionate remedy would be to discount the credibility and weight we give to his opinions."

This article was originally published by The Hollywood Reporter.