Viacom on Thursday reported better-than-expected adjusted fiscal second-quarter earnings and unveiled restructuring and programming charges in its media networks unit worth $280 million as it continues to rebuild its business.

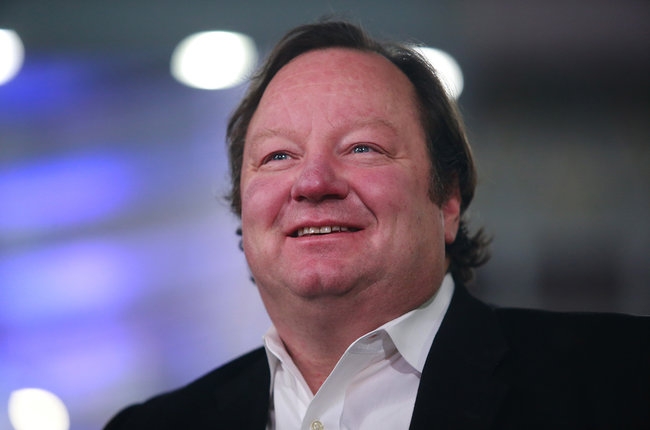

The entertainment conglomerate, led by CEO Bob Bakish and controlled by the Redstone family, reported adjusted earnings of $317 million, or 79 cents per share, compared with 76 cents in the year-ago period. Wall Street had on average forecast 59 cents per share. Including the charges, net earnings fell 60 percent to $121 million, or 30 cents.

But given the one-time nature of the charges, Wall Street focused on the adjusted earnings, and Viacom's stock was more than 3 percent higher before the market open. Quarterly revenue rose 8 percent to $3.26 billion, also exceeding Wall Street estimates.

As part of its fiscal first-quarter earnings report in February, Viacom had unveiled Bakish's strategy to focus on its six core brands (MTV, Nickelodeon, Nick Jr., Comedy Central, BET and Paramount) and look for a "deeper integration" of Paramount Pictures with the rest of the company.

As part of its restructuring, Bakish has also picked new executives to head up key networks, such as Chris McCarthy who is now overseeing MTV in addition to VH1 and Logo, and new leaders have changed the programming strategies. Thursday's programming charges are believed to be for shows that have been reduced in terms of orders or won't happen now.

The company said Thursday that it took "restructuring and programming charges of $280 million resulting from the execution of new strategic initiatives, including the prioritization of six flagship brands."

Viacom's film unit reported a narrowed adjusted quarterly operating loss of $66 million, compared with a $136 million loss in the year-ago period, driven by higher revenue, partially offset by higher expenses.

Film revenue rose 37 percent to $895 million. Theatrical, home entertainment, licensing and ancillary revenue were all higher. "Paramount Television continues to build on its growing success as a premier content producer, delivering multiple hits including original series 13 Reasons Whyand Shooter," the company said in touting that its TV production arm is starting to contribute.

Among theatrical releases, xXx: Return of Xander Cage didn't do huge business in the U.S., but performed strongly abroad. The quarter also included the release of Monster Trucks, for which Viacom previously took a $115 million write-down. Overall, theatrical revenue rose 10 percent driven by a 98 percent international gain, led by xXx, that more than offset a 45 percent domestic drop.

Ancillary revenue in the film unit increased 149 percent to $112 million in the quarter, "primarily driven by the sale of a partial copyright interest in certain current year releases related to a film slate financing arrangement," Viacom said in a reference to a slate deal with two Chinese partners.

Revenue was also up, 1 percent, or 2 percent when excluding currency fluctuations, at the company's media networks unit. Its Helping to boost it were the acquisition of Argentine network Telefe and higher affiliate fee revenue. But advertising revenue was down 4 percent in the U.S., in line with management guidance, while it rose 1 percent worldwide when adjusting for foreign currency fluctuations.

Media networks unit adjusted operating income dropped 7 percent to $747 million as the higher revenue was more than offset by advertising and promotion costs and increased expenses related to the Telefe acquisition.

Among key Viacom networks, Nickelodeon reported year-over-year ratings growth of 6 percent with kids aged 6-11 and 5 percent with kids 2-11. "VH1 continues its resurgence with a seventh consecutive quarter of year-over-year ratings growth, while TV Land and CMT achieved their best quarterly ratings in three years," the company added.

"We executed quickly on our strategic plan, making significant organizational changes to better focus and align Viacom’s brand portfolio and ensure strong leadership, including the appointment of Jim Gianopulos to chart a new course at Paramount," said Bakish.

He again emphasized his focus on working collaboratively with others, saying: "We are working diligently to cement Viacom as a partner of choice in the industry, presenting new and reinvigorated brand strategies for our advertisers, producing creative and flexible new opportunities with our distributors and recommitting ourselves to be the home for the world’s best talent."

And Bakish provided an update on the company's overall financial and debt position. “Viacom also took significant steps forward on our plan to strengthen our balance sheet, improve our leverage profile and enhance liquidity," he said. "Since the end of our first fiscal quarter, we completed a successful hybrid debt offering, redeemed outstanding debt and executed on the sale of non-core assets, including the pending sale of our stake in Epix."

Concluded the CEO: "There is a lot of work still to do, but we are making important changes at Viacom, taking substantial strides towards revitalizing our portfolio of brands and returning the company to consistent top-line growth.”

On Wednesday, entertainment industry stocks, including that of Viacom, fell sharply amid latest investor concerns about pay TV subscriber and advertising trends.