Donald Trump still hasn't shared his most recent tax return. The president has cited an ongoing tax audit by the IRS as one reason. He surely would not wish any tax agent to leak it. But under Trump's watch, the Justice Department is now battling a privacy lawsuit from a citizen whose tax information was disclosed on the Howard Stern Show. On Monday, government lawyers claimed immunity.

Judith Barrigas was the unfortunate woman who found her conversation with an IRS agent aired to Stern's radio audience on May 19, 2015. She had called the IRS's service center to discuss how the tax agency had applied prior year liabilities to her tax refund. She was connected to Jimmy Forsythe, an IRS agent who before taking her call, had dialed up The Howard Stern Show using another phone line. Forsythe was put on hold.

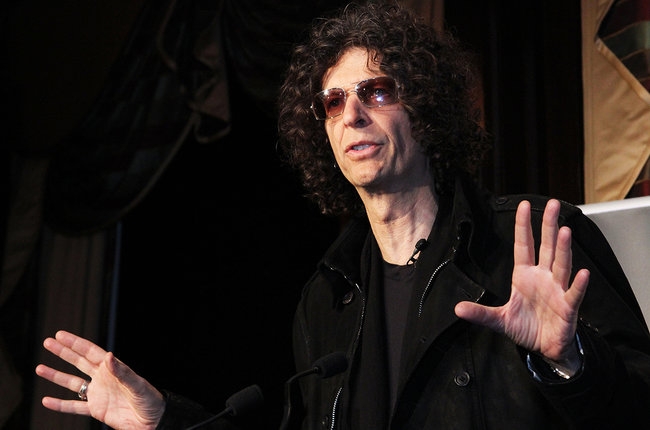

"Jimmy, go ahead," said Stern that day. "You're on the air in Long Island... Jimmy?"

"$71 due on the 20th," said Forsyth.

"Jimmy, you're on the f—ing air," exclaimed Stern.

"What is he doing?" asked Stern's co-host Robin Quivers. "Making a transaction?"

Forsythe continued to talk to Barrigas for several minutes without being aware that Stern, Quivers, and their audience were listening in and making fun of what was being said. "It sounds like a raw deal," said Stern at one point, and when Forsyth finally finished with Barrigas and checked in on his other line, he heard Stern comment, "Dude, we just heard your whole transaction. What's going on, man? You got the most boring job, dude."

The conversation is now making for a fairly exciting and novel lawsuit in Massachusetts federal court. There, the Justice Department has filed a motion to dismiss with the argument that sovereign immunity bars Barrigas' claims. The government points to what's known as the "tax exception" to jurisdiction under the Federal Tort Claims Act.

"The language of the tax exception 'has been interpreted broadly,'" states the motion to dismiss. "Indeed, the [tax exception] encompasses any activities of an IRS agent even remotely related to his or her official duties of assessing or collecting taxes, including unlawful or unauthorized actions."

Government lawyers add that the tax exception "is broad enough to encompass... communications to third parties regarding a person or a group of persons' tax liability" as well as barring "tort claims for reputational harm arising out of the reporting of a tax debt to third parties during activities related to tax assesment or collection."

The motion from Trump's DOJ, which can be read in full here, contends that Barrigas' conversation with the IRS is covered.

"Even if the call between Plaintiff and Forsyth were not itself directly in furtherance of the collection of taxes, that would not prevent the tax exception from applying," continues government lawyers. "Even assuming Forsyth committed an 'egregious breach and invasion of privacy' by disclosing return information on The Stern Show, even a significant lapse in judgment does not prevent the tax exception from applying."

Next, the government argues for the application of rules from New York, where Forsyth took the call. According to the government, the tort of invasion of privacy is not actionable in Trump's home state. New York does have a civil rights statute that guard against the misappropriation of a person's likeness, but the government says it does Barrigas no good. Even if the case is grounded in Massachusetts law, the Justice Department points to the fact that Forsyth's name was never used and her voice was never heard for the proposition she's not alleging anything "sufficiently personal or intimate."

Stern and his production company have also filed a motion to dismiss. He's making several different arguments. First, he's contending that liablity under the Internal Revenue Code pertains to "certain enumerated groups of people with access to tax returns" and not himself. Second, he's telling a judge that the negligence claim fails because he owed no sort of duty to Barrigas.

"Finally, the plaintiff asserts a claim against the Show Defendants for intentional infliction of emotional distress," states Stern's court filing (read here). "The Massachusetts Supreme Judicial Court has explained that this cause of action applies only to conduct that 'goes beyond all possible bounds of decency, and is regarded as atrocious, and utterly intolerable in a civilized community.' That simply was not the case here. Broadcasting a three-minute segment of an IRS agent’s side of a conversation with an unidentified tax payer simply does not rise to the level of 'atrocious' and 'utterly intolerable' behavior that is required to state a claim for intentional infliction of emotional distress. Moreover, the plaintiff has not alleged facts supporting a claim of severe emotional distress, as the Supreme Judicial Court requires, and the Show Defendants did not act with recklessness or intent to hurt the plaintiff – in fact, they did not even know who was on the other side of the call."

This article was originally published by The Hollywood Reporter.