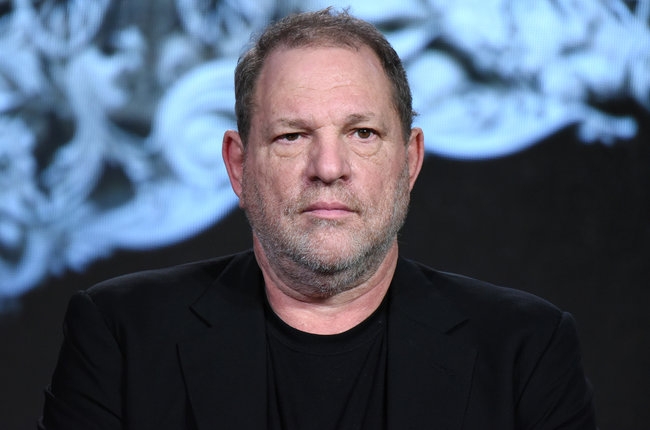

Disgraced mogul Harvey Weinstein has resigned from the board of The Weinstein Co.

On Tuesday, the remaining members of the TWC board — including co-chairman Bob Weinstein — voted to ratify Harvey's Oct. 8 termination as co-chairman, and to consider an immediate capital infusion from Tom Barrack's Colony Capital that opens the door for Colony to buy the film and television production venture, or a significant portion of its assets.

Harvey — who owns 23 percent of TWC — called into the board session, according to insiders. Powerhouse litigator Patricia Glaser is representing him in regards to his termination and his stake in the company.

Harvey was fired following an exposé in The New York Times that detailed numerous allegations of sexual harassment on the part of the mogul. His brother Bob and COO David Glasser believed the company could weather the scandal, but more serious allegations of sexual misconduct, including rape, were raised in subsequent stories in The New Yorker and the Times, throwing TWC into a state of chaos.

Analysts and finance attorneys say it won't be easy rescuing TWC, whose relationship with talent, agents and other Hollywood power brokers has been severely jeopardized. Also, TWC was struggling financially even before becoming engulfed in one of the biggest scandals in Hollywood history.

Attorney Larry Hutcher, a specialist in “corporate divorce” at Davidoff Hutcher and Citron, warns that Harvey still has significant power and can potentially kill any deal simply by refusing to sell his 20-plus percent stake in the business. “He’s in a very favorable position because he likely cannot be compelled to sell his shares, and he has significant rights as a large shareholder. If I were advising Colony, I would stipulate that a sale include Harvey’s interest, but his sense of entitlement might cause him to hang on, even if it meant the death knell of the company," Hutcher tells The Hollywood Reporter.

If TWC is to forge a new future, either in whole or in pieces, one option is for Bob Weinstein to exit, especially in light of an Oct. 17 sexual harassment claim by Amanda Segel, an executive producer on Spike TV's The Mist.

And while Bob Weinstein says he was unaware of his older brother's alleged predatory ways, creative partners may not want to do business with TWC if he is still there, sources say. Already, several filmmakers, including Lin-Manuel Miranda, have called on the company to let them take their film projects elsewhere, while Amazon Studios and others are reviewing their options in terms of television series produced by TWC.

Barrack's plan — which could still fall apart — is to break up and either sell off parts or bring in investors to salvage them, a source tells THR. After a flurry of dealmaking, Barrack coulid see the remainder, much as Colony and a consortium of investors did with Miramax.

TWC is now exposed to potential investor and victim lawsuits. To avoid exposure, any potential buyer could acquire whichever assets it deems worthy instead of buying the company outright. Another option is to buy TWC out of Chapter 11 bankruptcy, which would offer some amount of protection against such lawsuits.

Colony and TWC make for interesting bedfellows. Harvey is a well-known Hollywood Democrat who donated millions over the years to Democrat causes and candidates, including former President Barack Obama and Hillary Clinton.

Barrack, who is executive chairman of Colony, was one of President Donald Trump’s most prolific donors. He hosted a major fundraiser at his home where the then-candidate hobnobbed with many of Hollywood’s quietly conservative denizens. After the 2016 presidential election, Trump considered naming Barrack treasury secretary, though the job ultimately went to Dune Entertainment Partners chairman Steven Mnuchin.

In 2010, Colony bid against the Weinstein brothers for control of Miramax, the celebrated independent film studio the siblings launched in 1979 and then sold to Disney in 1993. Harvey and Bob left Miramax in 2005 in an acrimonious split with Disney.

When Disney put the asset up for sale, a consortium of investors that included Colony put up $663 million, $100 million more than the Weinstein bid. In 2013, any bad blood seemed to have been forgiven when Miramax and TWC entered into a multiyear development and distribution deal drawing from the Miramax library.

When Miramax was sold last year to Qatar-based BeIN Media Group, the price was undisclosed, but Colony reportedly earned more than a 100 percent return on its investment, a success that apparently has whetted its appetite for another entertainment investment.

In Monday's statement announcing Colony's proposed lifeline to TWC, Barrack said, “We are pleased to invest in The Weinstein Company and to help it move forward. We believe the Company has substantial value and growth potential, and we look forward to working with the Company's critical strategic distribution and production partners to help preserve and create value for all stakeholders, including its employees. We will help return the Company to its rightful iconic position in the independent film and television industry."

Bob Weinstein, who is running TWC with Glasser, was not quoted in the statement (last week, he said the film and television company wasn't for sale).

Instead, that duty went to board member Tarak Ben Ammar, who said, “On behalf of the board, we are pleased to announce this agreement and potential strategic partnership with Colony Capital. We believe that Colony's investment and sponsorship will help stabilize the Company's current operations, as well as provide comfort to our critical distribution, production and talent partners around the world. Colony's successful experience and track record in media and entertainment will be invaluable to the Company as we move forward.”

"Colony, like a lot of private equity funds, does distressed lending. They look for opportunities," says another source. "Think of this as a very expensive short-term loan. In the meantime, they'll talk about whether they can buy the company."

Colony is a private equity firm that is part of Colony NorthStar, an investment firm Barrack founded in 1991 that now has $56 billion in assets under management. While it is publicly traded on the New York Stock Exchange — where it sports a $7.4 billion market cap — it is not a media-entertainment company, so it would be seen simply as an investor seeking to profit by turning around a distressed asset, and in doing so helping people to keep their jobs.

“The Weinstein Co. is probably not saleable to a public media company at the moment and PR would be unbearable,” says Ben Weiss, chief investment officer at 8th & Jackson Capital Management. “Colony could acquire the intellectual property, including the development pipeline, programing slate and library rights, at a discount to market prices because of the turmoil. Colony can rebrand it, appropriately capitalize in more IP, and then sell it to a strategic buyer down the road, possibly in a tax-efficient equity swap, for a large premium.”

Some, though, don’t see TWC ever returning to its glory days as a producer of high-profile, Oscar-winning films that return significant profits.

“I can’t imagine go-forward projects will last, and we have already seen cancellations,” says Steven Birenberg of Northlake Capital Management. “I’d imagine they got good terms and see value against those terms. The library must have value.”

This article originally appeared in THR.com.